Transforming Finance with Generative Models

Generative models are powerful tools for creating complex data and making accurate industry predictions. Their use is growing, especially in finance, where analyzing intricate data and making real-time decisions is crucial.

Core Elements of Generative Models

- Large volumes of high-quality training data

- Effective tokenization of information

- Auto-regressive training methods

The financial industry, with its complex data interactions, is an ideal area for these models to make a significant impact.

Challenges in Financial Markets

One major challenge is managing the vast amount of trade and order data, which needs detailed analysis for actionable insights. Traditional tools struggle to simulate or predict complex market behaviors. Their inflexibility means they often cannot adapt to fast-changing market conditions or identify anomalies that indicate risks, making timely decision-making difficult.

Current financial prediction tools often require constant updates and are resource-intensive, limiting their scalability and adaptability. They can’t effectively model the interactions between individual trades and overall market trends, which reduces their predictive power.

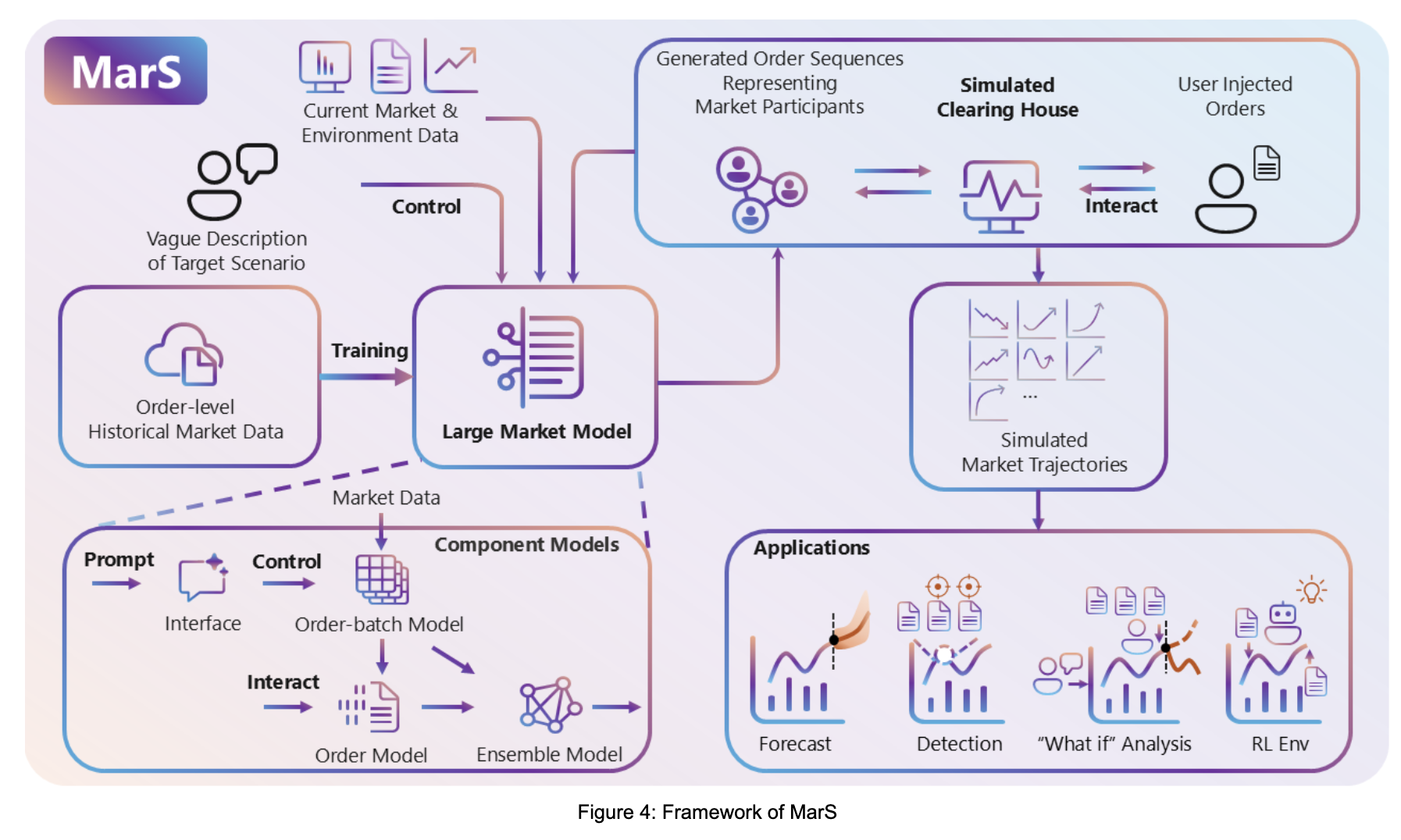

Innovative Solutions: MarS and LMM

Microsoft researchers have developed the Large Market Model (LMM) and the Financial Market Simulation Engine (MarS) to address these challenges. These tools utilize generative models and specific financial datasets to simulate realistic market conditions with remarkable accuracy.

Key Features of MarS

- Tokenization of order flow data: Captures market feedback and trading dynamics.

- Simulation of complex market behaviors: Models interactions between individual orders and market trends.

- Hierarchical diffusion models: Predict rare events like market crashes.

- Generation of synthetic market data: Uses natural language descriptions to model diverse financial scenarios.

Performance Highlights

MarS has shown significant improvements in predictive accuracy:

- 13.5% improvement: In stock price forecasts at a one-minute horizon.

- 22.4% improvement: At a five-minute horizon.

- Effective in detecting risks: Help regulators monitor market integrity and identify unusual activities.

Conclusion

The research highlights how MarS and LMM effectively overcome the limitations of traditional financial tools, leading to better predictive accuracy and adaptability. They are essential for modeling rare market scenarios, ensuring robust applications in various financial tasks.

For further exploration, check the details and GitHub page. Follow us on Twitter, join our Telegram channel, and LinkedIn group for updates, or subscribe to our newsletter for insights on leveraging AI in your business.

If you’re ready to enhance your business with AI, consider the solutions offered by MarS. Identify opportunities for automation, define key performance indicators (KPIs), select tailored AI tools, and implement them gradually for the best results. For AI KPI management advice, contact us at hello@itinai.com.

Discover how AI can revolutionize your sales processes and customer engagement at itinai.com.