Cybersecurity in Digital Banking: A Growing Concern

As technology advances and internet usage increases, cybersecurity is becoming crucial, especially in digital banking. While digital systems provide efficiency and convenience, they also open doors to fraud risks like identity theft. Traditional security methods struggle against sophisticated fraud tactics, leading financial institutions to explore AI-based solutions.

The Value of AI in Fraud Detection

AI improves fraud detection by:

- Analyzing large amounts of transaction data.

- Identifying suspicious patterns.

- Automating threat detection processes.

However, challenges such as high costs and data quality issues remain, particularly for smaller institutions. This highlights the need for effective cybersecurity measures.

Limitations of Current Bank Security Systems

Many banks rely on outdated technologies, making them vulnerable to advanced cyber threats. Traditional reactive measures only respond after a breach, which is often too late. Legacy systems lack real-time monitoring and multi-factor authentication, increasing their risk of financial losses and regulatory penalties.

Proactive Strategies for Enhanced Security

Banks need to adopt proactive, technology-driven strategies that include:

- Utilizing AI, machine learning, and behavioral analytics.

- Promoting cybersecurity awareness among employees.

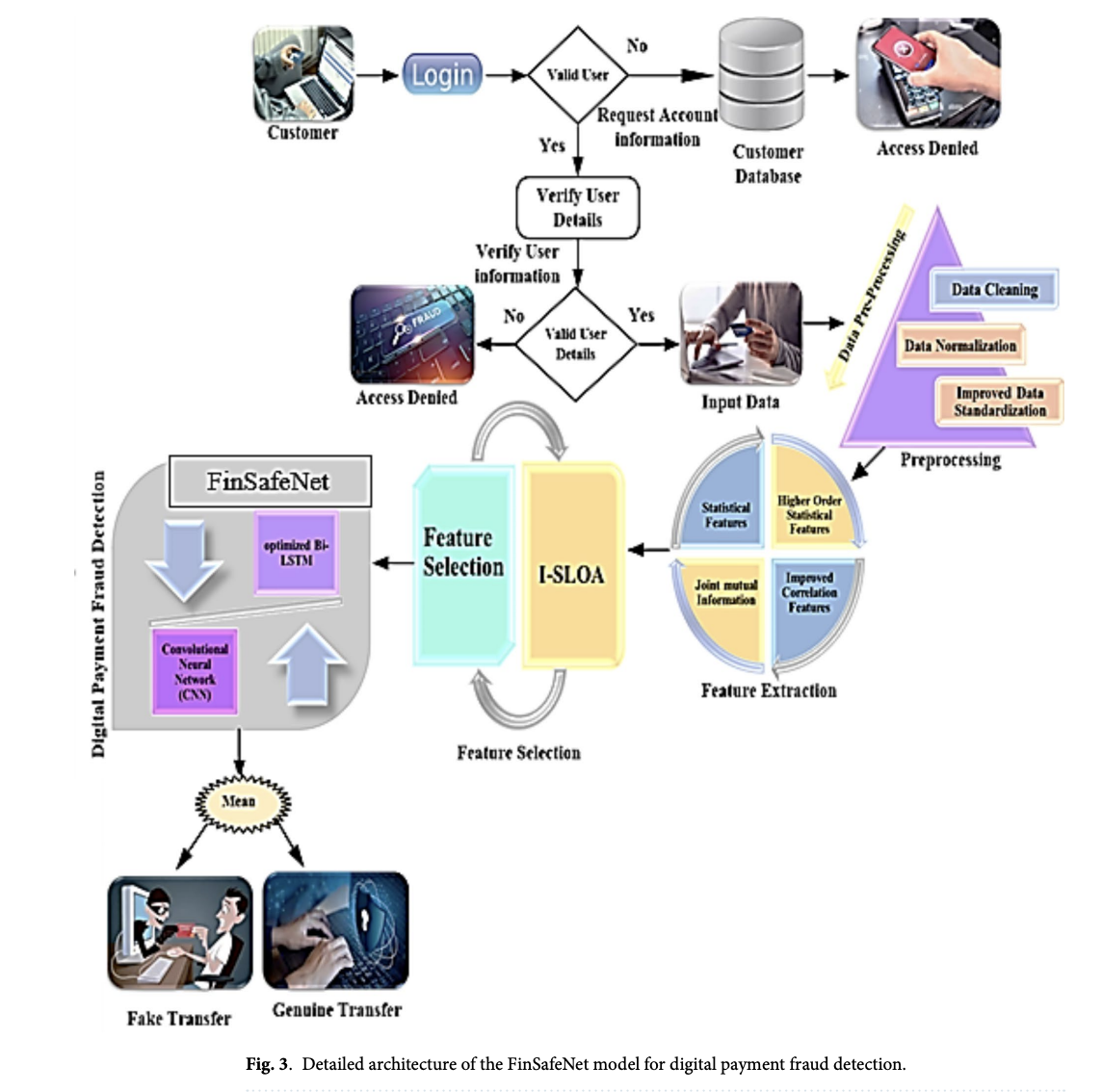

Introducing FinSafeNet: A Breakthrough in Digital Banking Security

Researchers from various universities have developed FinSafeNet, a deep-learning model designed for secure digital banking. This model:

- Utilizes advanced techniques like Bi-LSTM and CNN.

- Incorporates an Improved Snow-Lion Optimization Algorithm for efficient feature selection.

- Achieved 97.8% accuracy in fraud detection on the Paysim database.

How FinSafeNet Works

The model processes data from simulated transactions, cleaning and normalizing it to identify key features for fraud detection. It outperforms traditional methods and is highly effective due to its dual-attention mechanism and optimized feature selection.

Conclusion: The Future of Digital Banking Security

FinSafeNet represents a significant advancement in digital banking security. With its high accuracy and efficiency, it is well-suited for real-time deployment in various banking environments. Future integration with blockchain technology could further enhance transaction security.

Stay Connected

For more insights into AI solutions, follow us on:

Join our newsletter and be part of our growing community of over 55k members on our ML SubReddit.

Upcoming Event

Don’t miss our live LinkedIn event titled ‘One Platform, Multimodal Possibilities,’ featuring industry experts discussing innovative data development for multimodal AI models.

Transform Your Business with AI

Explore how AI can redefine your operations:

- Identify automation opportunities.

- Define measurable KPIs.

- Select suitable AI solutions.

- Implement gradually for maximum impact.

For AI KPI management advice, connect with us at hello@itinai.com.